how to become tax exempt at home depot

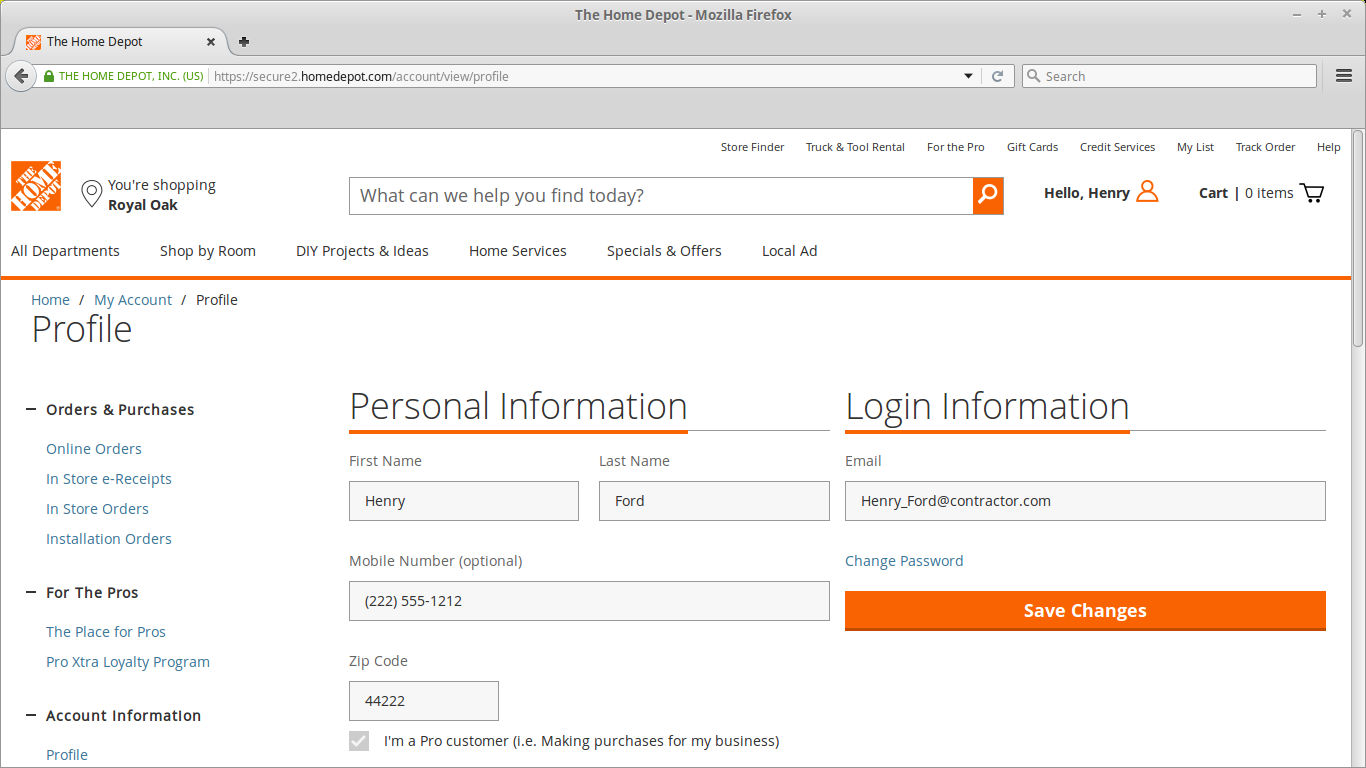

Phone number Make sure this phone number is registered. Use your Federal Government Purchase Card at checkout.

Home Depot Raised Their Prices Because It S Tax Free Weekend In Massachusetts R Assholedesign

Theres also a link to a FAQ page adjacent to the registration button.

. Head to the Home Depot tax exempt application page and click the Register Online option. Here you will find information that will allow you to reach the goals you have in life. To register for a number start on tax.

If you qualify as a tax exempt shopper and already have state or federal tax IDs register online for a Home Depot tax exempt ID number. TAX INFORMATION Last Name To be approved for a tax exemption purchasing card complete this form attach a copy of your tax-exemption certicate and mail in this postage-paid. Use your Home Depot tax exempt ID at checkout.

This number is different from your state tax exemption ID. Easily follow these steps and start dropshipping using Home De. Here it is guys.

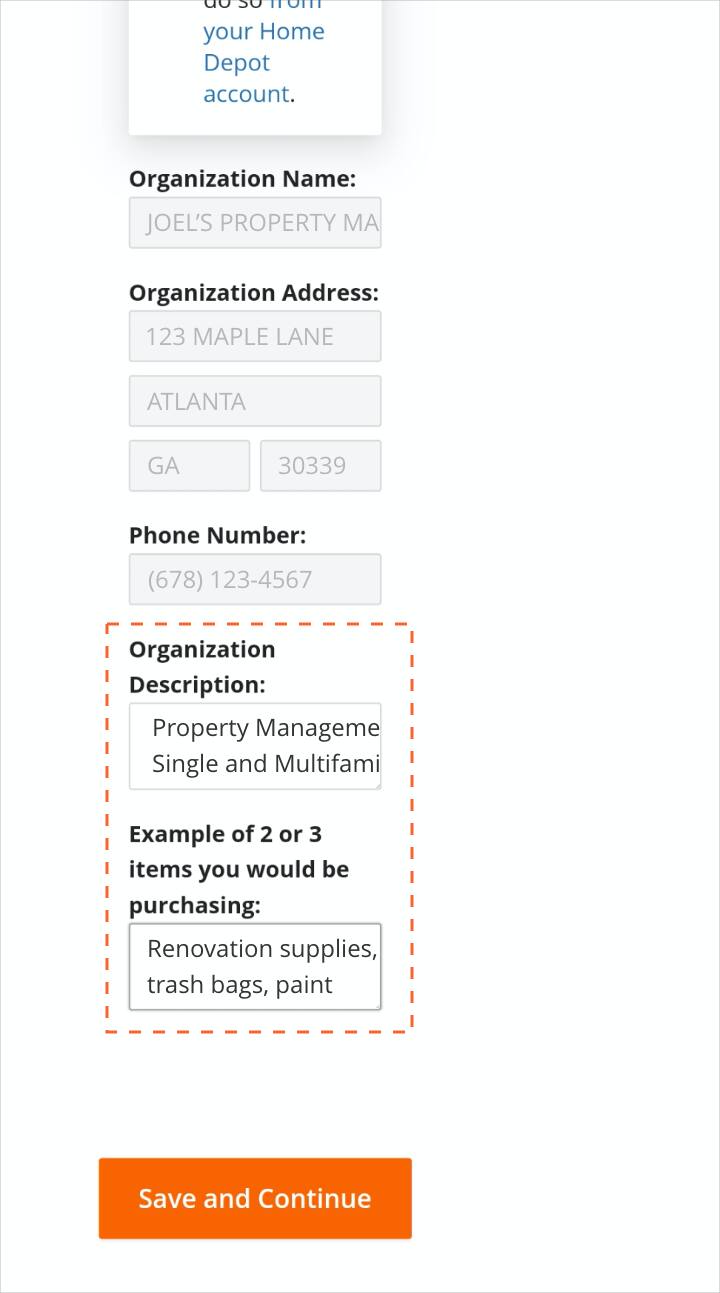

To apply for a Tax ID you need to go to The Home Depots website here and provide the following information. So Lets Try itHow to get Home Depot Tax Exemp. Establish your tax exempt status.

In this video you will learn how to apply for tax exemption at home depotFor a better understanding of this program you have to watch the first video to t. If you qualify as a tax exempt shopper and already have state or federal tax IDs register online for a Home Depot tax exempt ID number. Establish your tax exempt status.

Find the document you want in our library of legal templates. As of January 31 2020 Form 1023 applications for. Welcome to my channel.

News discussion policy and law relating to any tax - US. A hold-your-hand video that will help you gain tax exemption from Home Depot. The required fields are marked with red asterisk marks.

Here you will find information that will allow you to reach the goals you have in life. How can I avoid paying taxes at Home Depot. If you have any questions about Home Depot Tax Exemption please call The Home Depot Tax Department at 877 434.

What Does Tax Exempt Mean. Once you have followed the steps outlined on this page you will need to determine what type of tax-exempt status you want. Keep to these simple instructions to get Home Depot Tax Exempt ready for sending.

Tax Exempt Form Home Depot Income or transactions not subject to federal state or municipal taxes are tax-exempt. Home Depot allows you to select your own Home Depot. It takes only a few minutes.

So Lets Try itHow To Get Home Depot Tax Exemp. Boca Raton FL 33431-9872. To shop tax free you need a Tax Exempt ID from The Home Depot.

Enter your business information and click Continue. Office Depot LLC. Welcome to my channel.

No need to register. Who can I call for more information on the Tax Exempt process. GSA customers using an IMPAC or GSA smart card will automatically be handled by the system as before.

How To Register For A Tax Exempt Id The Home Depot Pro

How To Apply For Your Resale Tax Status From Home Depot Youtube

Automate Home Depot Pro Xtra Receipts

36 Home Depot Hacks You Ll Regret Not Knowing The Krazy Coupon Lady

How To Purchase From Home Depot Uf Procurement Uf Procurement

How To Get Home Depot Tax Exemption Home Depot Tax Exempt Application Amazon Dropshipping Course Youtube

Home Depot Pro Desk Vs Lowe S Pro Desk Workiz

Iama President Of A 501c3 Tax Exempt Non Profit That Is Called Fale We Teach People To Pick Locks Ama R Iama

Automate Home Depot Pro Xtra Receipts

Do Tax Exempt For Amazon Walmart And Home Depot All States By Mahnooreve Fiverr

Home Depot Tax Exemption Application Youtube

Home Depot Tax Exemption Application Youtube

Can You Avoid Paying Sales Tax At The Home Depot Hammerzen

No Taxes Texans Can Buy Emergency Supplies Tax Free This Weekend

Barnett The Home Depot Pro Specialty Trades Electrical Hvac And Plumbing Supplies The Home Depot Pro Specialty Trades

Help And Customer Service Center

36 Home Depot Hacks You Ll Regret Not Knowing The Krazy Coupon Lady